Global Carbon Verification Market is Estimated To Witness High Growth Owing To Increasing Focus on Reducing Carbon Emissions

Carbon Verification Market

The Global Carbon Verification Market is estimated

to be valued at US$12.73 billion in

2023 and is expected to exhibit a CAGR

of 26% over the forecast period 2023

to 2030, as highlighted in a new report published by Coherent Market

Insights.

Market Overview:

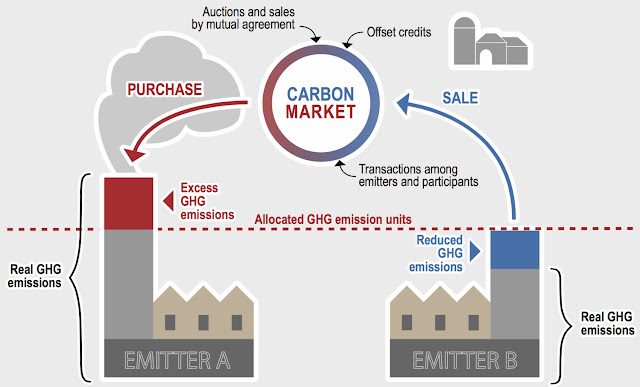

Carbon verification refers to the process of independent third-party validation

of emission reduction projects or carbon credits generated by enterprises.

Carbon verification ensures the Credibility, Transparency, Accuracy, and

Integrity of carbon credits. With stringent government policies and regulations

governing carbon emissions across various industries, carbon verification is

playing a key role in enhancing organizations' sustainability credentials while

showcasing their efforts towards reducing carbon footprint.

Market key trends:

One of the major trends driving the growth of the carbon verification market is

increasing focus on Scope 3 emissions accounting and reporting. With growing

emphasis on measuring and managing Scope 3 emissions, which include all indirect

emissions that occur in a company's value chain, carbon verification is gaining

prominence. Assessment and verification of Scope 3 emissions helps companies

identify significant emission sources, engage suppliers to reduce emissions,

and integrate climate considerations into strategic planning. Several large

corporations have already announced targets to reduce Scope 3 emissions,

driving the need for robust carbon accounting practices and third-party

verification.

Porter's Analysis

Threat of new entrants: Low capital requirements and established buyers limit

threats. However, buyers prefer certified firms with scale and expertise.

Bargaining power of buyers: Buyers have significant power as they can select

from various certifiers. Buyers often collaborate to standardize requirements.

Bargaining power of suppliers: Suppliers have moderate power due to specialized

skills and technologies required for certification. However, demand from buyers

limits suppliers' power.

Threat of new substitutes: Threat is low as certification requires expertise

and is often mandatory for emissions reporting. Verification offers credibility

lacking in alternatives.

Competitive rivalry: Intense as firms compete on capabilities, expertise,

geographical reach and price. Scale and reputation differentiate large

certifiers from small players.

SWOT Analysis

Strengths: Strong technical skills and global networks. Reputation and scale

provide advantages in winning large clients.

Weaknesses: High compliance costs. Smaller players have narrower service

portfolios.

Opportunities: Growing carbon regulations worldwide. Emerging opportunities in

renewable energy, carbon offset verification.

Threats: Commoditization of basic services. Disruptions from new technologies

that reduce on-site audits.

Key Takeaways

The global Carbon Verification Market is expected

to witness high growth, exhibiting CAGR of 26% over the forecast period, due to

increasing carbon regulations worldwide. Stringency of regulations is driving

demand for third-party verification from large emitters.

The US and European markets currently dominate due to early adoption of carbon

targets. However, China and India are emerging as high potential markets,

supported by expanding emissions trading mechanisms. Southeast Asian nations

are also strengthening commitments to reductions.

Key players operating in the carbon verification market are DNV GL, SGS SA,

Bureau Veritas, TÜV NORD GROUP, Intertek Group plc, Carbon Trust, First

Environment, Inc., ERM Certification and Verification Services, NSF

International, UL LLC.

Comments

Post a Comment