Carbon Offset Market To Witness Strong Growth Due To Increasing Carbon Emissions

Carbon Offset Market

The Carbon Offset

Market is estimated to be valued at US$

414.80 billion in 2023 and is expected to exhibit a CAGR of 31.7% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent

Market Insights.

Market Overview:

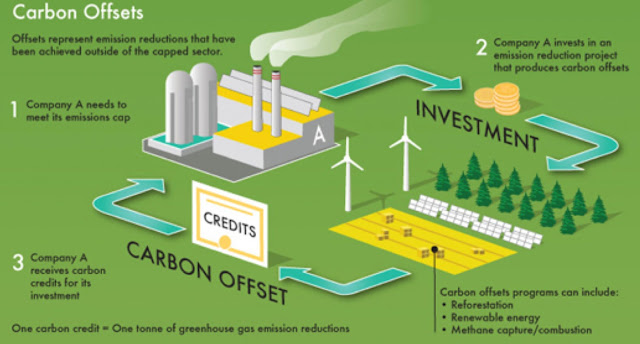

Carbon offsetting involves balancing carbon emissions by funding projects that

reduce greenhouse gas (GHG) from the atmosphere. This is done by supporting

renewable energy projects, reforestation efforts, agricultural practices that

store carbon in soils or projects that capture methane from landfills. The need

for carbon offsets arises due to increased emissions from various sources like

transportation, electricity generation, industrial activity etc. Carbon offsets

provide a way to mitigate climate change through investments in green projects.

Market key trends:

One of the major trends fueling the carbon offset market is increasing carbon

emissions globally due to fast industrialization and growing population. As per

International Energy Agency (IEA), global carbon emissions rose by 1.7% in 2021

compared to previous year and touched highest levels in history. Transport

sector accounted for 24% of global emissions. This has increased the need for

offsetting emissions through renewable projects. Many companies are now

committing to become carbon neutral by offsetting their residual emissions

through investments in certified carbon offset projects. Governments are also

emphasizing on decreasing reliance on fossil fuels to mitigate climate change

impacts. This is expected to drive further growth in carbon offsets market over

the coming years.

Porter’s Analysis

Threat of new entrants: Low capital requirements and established distribution

channels lower barriers to entry. However, industry players have strong brands

and customer loyalty.

Bargaining power of buyers: Large buyers can negotiate lower prices but

individual consumers have limited influence given the commodity nature of

offsets.

Bargaining power of suppliers: A few large offset project developers and

registries exist, giving them some pricing power depending on scarcity of

certain project types.

Threat of new substitutes: Alternatives like direct emissions reductions and

carbon removal technologies pose risks long-term but are not yet direct

substitutes.

Competitive rivalry: Fierce competition exists on price and variety of offset

types offered resulting in industry consolidation.

SWOT Analysis

Strengths: Voluntary offset market is growing rapidly due to increased

corporate net-zero pledges. Offsets offer a flexible, cost-effective solution

to balance hard-to-abate emissions.

Weaknesses: Additionality and permanence concerns undermine

integrity and consumer trust in some offset types. Administrative burdens

increase costs for small buyers and sellers.

Opportunities: Expanding compliance offset demand from

emerging carbon pricing initiatives worldwide presents major opportunities. New

offset standards and registries emerging to strengthen environmental integrity.

Threats: Policy uncertainty around future use and

eligibility of offsets in emission regulations pose challenges. Competition

from alternatives like carbon removal technologies and direct emissions

reductions.

Key Takeaways

The global Carbon Offset Market is expected to

witness high growth, exhibiting CAGR of 31.7% over the forecast period 2023 to

2030, due to increasing corporate net-zero commitments and emergence of carbon

pricing policies worldwide. The market size is projected to reach US$ 414.80

billion in 2023.

The North American region currently dominates the carbon offset market,

accounting for over 35% of global transaction volume in 2022. Strong regional policy

drivers like sub-national carbon pricing initiatives in Western Climate

Initiative and RGGI states are fueling offset demand. The regional market is

projected to grow at 30.2% CAGR during the forecast period, driven by emergence

of federal carbon pricing and stricter net-zero plans at state/provincial

level.

Asia Pacific region is identified as the fastest growing regional market for

carbon offsets, projected to expand at 33.6% CAGR between 2023-2030. The

strength of industrial and energy sector along with government initiatives in

countries such as China, Japan, India, South Korea are strengthening regional

carbon offset demand.

Key players operating in the carbon offset market are 3Degrees Inc.,

NativeEnergy, ClimatePartner, Carbon Credit Capital, Terrapass, Renewable

Choice Energy, Gold Standard, Offsetters, South Pole Group, Veridium, Cool

Effect, ClimateCare, MyClimate, Forest Carbon, Verified Carbon Standard. Among

these, Gold

Comments

Post a Comment